How to Match Paint with Architectural Style

Learn how to match paint with your home’s architectural style discover timeless color pairings that enhance character, balance design, and boost curb appeal.

PPG has officially sold its U.S. and Canadian architectural coatings division to private equity firm American Industrial Partners for $550 million, a move that reshapes the competitive landscape of residential and commercial coatings. The transition the new business is now called The Pittsburgh Paints Company could affect pricing, distribution, brand loyalty, and supplier relationships for contractors and homeowners. Here’s what to watch.

PPG’s decision to sell its North American architectural coatings business marks a major strategic shift. The division generated around two billion dollars in annual sales and included some of the most recognized brands in both the residential and commercial paint markets. By transferring ownership to American Industrial Partners, PPG is refocusing on its higher margin global coatings operations while allowing the new Pittsburgh Paints Company to concentrate solely on North American growth.

For most contractors and homeowners, this sale doesn’t mean an immediate change to the products they use. Glidden, Olympic, Dulux, and other familiar lines will continue to exist under the new company. However, over time, subtle differences in pricing, packaging, and distribution are likely as the new owners streamline operations and adjust supply chains to meet their profit goals.

Contractors should pay close attention to any formulation changes that occur during this transition. Private equity acquisitions often lead to production optimization efforts, which can include changes to manufacturing processes or material sourcing. Testing new batches on smaller jobs before committing to large scale projects is always a safe approach.

The sale could also influence how paint is distributed and sold in North America. Under American Industrial Partners, the Pittsburgh Paints Company is expected to focus on efficiency and margin control, which may affect dealer incentives, regional pricing, and bulk order discounts. Contractors who rely on consistent supplier relationships should maintain open communication with their reps to ensure continuity and competitive pricing as these adjustments take place.

Pricing pressure is another area to watch. The architectural coatings division was known for its modest profit margins under PPG, and the new ownership will likely seek to improve profitability. While that may not lead to immediate price hikes, it could mean fewer large promotional discounts or rebates. Contractors should be proactive in locking in pricing agreements and monitoring changes that might affect their job estimates.

For homeowners, the most visible impact will be the range of products available in local stores and the potential for rebranding. It’s possible that certain product lines will merge, be renamed, or receive packaging updates as the Pittsburgh Paints Company refreshes its identity. That said, the quality and color selection these brands are known for are expected to remain consistent.

Transitions of this scale often come with short term supply fluctuations. Contractors planning major projects in 2025 should consider ordering key materials earlier than usual to avoid delays while the new company finalizes distribution logistics. Maintaining some extra inventory of common paints or primers can help prevent interruptions during this adjustment period.

Despite the uncertainty that comes with any corporate shift, this change also opens opportunities. Smaller and regional paint brands may use this moment to expand their market share, offering alternatives for contractors seeking stable pricing and consistent availability. Keeping an open mind to new suppliers or coatings can help businesses stay competitive and resilient during times of transition.

The sale of PPG’s North American architectural coatings division is more than a financial move it’s a turning point in the paint industry. It signals consolidation, rebranding, and a more efficiency driven future. For contractors, this is the time to strengthen relationships with suppliers, test product consistency, and position their businesses as reliable partners through the changes ahead.

Learn how to match paint with your home’s architectural style discover timeless color pairings that enhance character, balance design, and boost curb appeal.

2025 marks a new era of collaboration discover why strategic partnerships between trades are key to stability, growth, and smoother construction projects.

Learn how to spot early signs it’s time to repaint peeling, fading, cracks, and stains can signal wear. Keep your home fresh and protected with timely updates.

Master surface preparation before painting learn pro tips for cleaning, sanding, patching, and priming to achieve flawless, long-lasting paint results every time.

Discover how to calculate paint quantity accurately for any project save money, avoid waste, and ensure perfect coverage with these simple professional tips.

Discover creative ways to use bold colors in your space learn how to balance vibrant tones with neutrals to create depth, personality, and modern style.

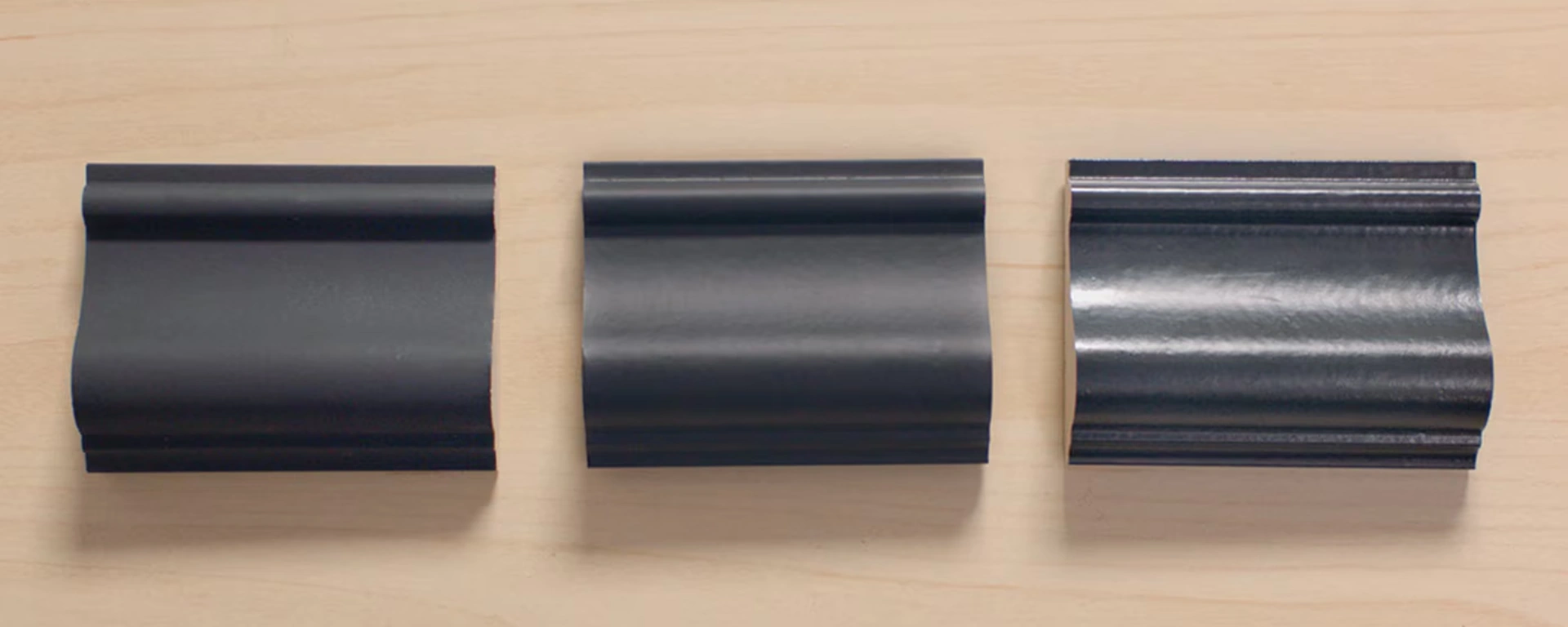

Understand paint sheen differences learn how matte, eggshell, satin, semi-gloss, and gloss finishes affect look, durability, and the best spaces to use each.

Unravel the complexities of house painting costs with our detailed guide. Discover what factors influence both interior and exterior painting expenses and how to budget for your project.

Master the art of exterior house painting with our ultimate guide. From selecting the right paint to surface preparation and application, transform your home’s exterior into a masterpiece.

Sherwin-Williams’ revised 2025 profit forecast signals rising costs and shifting demand here’s how it impacts contractors, homeowners, and paint projects ahead.

Fill out the form below and we’ll be in touch to discuss your painting needs, answer your questions, and provide a clear quote for your project.