How to Match Paint with Architectural Style

Learn how to match paint with your home’s architectural style discover timeless color pairings that enhance character, balance design, and boost curb appeal.

All Images Courtesy of Sherwin Williams

Sherwin Williams, the largest paint manufacturer in North America, has lowered its 2025 profit forecast after weaker than expected demand in both residential and commercial markets. The announcement reflects broader industry pressures from cautious homeowners to slowed construction starts and could influence paint pricing, supply trends, and renovation planning through 2026. Here’s what happened, why it matters, and what contractors and clients should watch next.

Sherwin Williams, the largest paint manufacturer in North America, recently lowered its 2025 profit forecast after seeing weaker than expected demand across the residential and commercial sectors. The announcement, reported by Reuters in July, highlights a cooling period for an industry that has been running hot since the pandemic.

The company pointed to softening sales in its residential repaint and light commercial segments. Many homeowners who invested heavily in renovations between 2020 and 2023 are now holding off on new projects, while builders are scaling back due to higher financing costs. It’s not a collapse it’s a reset. After years of nonstop growth, the paint and construction market is finally stabilizing.

One major factor behind this slowdown is the high cost of borrowing. Elevated interest rates continue to make it harder to finance new construction or large scale upgrades. Inflation has also played a part. Although supply chains have largely recovered, raw materials such as resins and titanium dioxide remain unpredictable, keeping production costs high. Together, these pressures have made property owners more cautious about starting new work.

For contractors and painters, this shift changes the rhythm of the year ahead. During the pandemic and recovery years, many trades were overwhelmed with bookings. Now, project volume is easing, and competition is tightening. But this can also be a positive change. The slowdown allows for better scheduling, improved communication, and a renewed focus on craftsmanship qualities that matter most when clients are selective about who they hire.

As for pricing, don’t expect paint costs to drop significantly. When demand dips, large manufacturers typically adjust production rather than flood the market with discounts. Sherwin Williams is known for protecting its premium lines, like Emerald and Duration, and prices in those categories are expected to hold. Any short term deals are likely to appear on overstocked products or in specific regions, not across the board.

For homeowners, this cooling market has a silver lining. With steadier demand, it’s becoming easier to find quality painters without long waiting lists or rushed timelines. Many contractors now have the capacity to take on smaller or custom projects that were harder to schedule during the peak years.

For professionals, the key is adaptability. Focusing on repainting, refinishing, maintenance, and smaller renovation work will keep business steady while the new build market regains momentum. Strong relationships with suppliers and repeat clients will matter more than ever.

Sherwin Williams’ revised forecast doesn’t signal trouble it signals maturity. The company remains profitable and confident about long term growth, especially in sustainable and high performance coatings. Analysts expect the market to gradually rebound through 2026 as inflation cools and financing becomes more accessible.

In many ways, 2025 is shaping up to be a transition year for the entire industry. The frenzy of the past few years is giving way to balance. Contractors can plan ahead with less uncertainty, suppliers can manage inventory more efficiently, and homeowners can make thoughtful, budget conscious upgrades without the rush.

The takeaway is simple: the market isn’t shrinking it’s catching its breath. For painters and builders who focus on quality, service, and smart planning, this phase can be just as profitable as the boom years, if not more sustainable.

Learn how to match paint with your home’s architectural style discover timeless color pairings that enhance character, balance design, and boost curb appeal.

2025 marks a new era of collaboration discover why strategic partnerships between trades are key to stability, growth, and smoother construction projects.

Learn how to spot early signs it’s time to repaint peeling, fading, cracks, and stains can signal wear. Keep your home fresh and protected with timely updates.

PPG sells its U.S. and Canadian architectural coatings business to American Industrial Partners, reshaping paint brands, pricing, and supply across North America.

Master surface preparation before painting learn pro tips for cleaning, sanding, patching, and priming to achieve flawless, long-lasting paint results every time.

Discover how to calculate paint quantity accurately for any project save money, avoid waste, and ensure perfect coverage with these simple professional tips.

Discover creative ways to use bold colors in your space learn how to balance vibrant tones with neutrals to create depth, personality, and modern style.

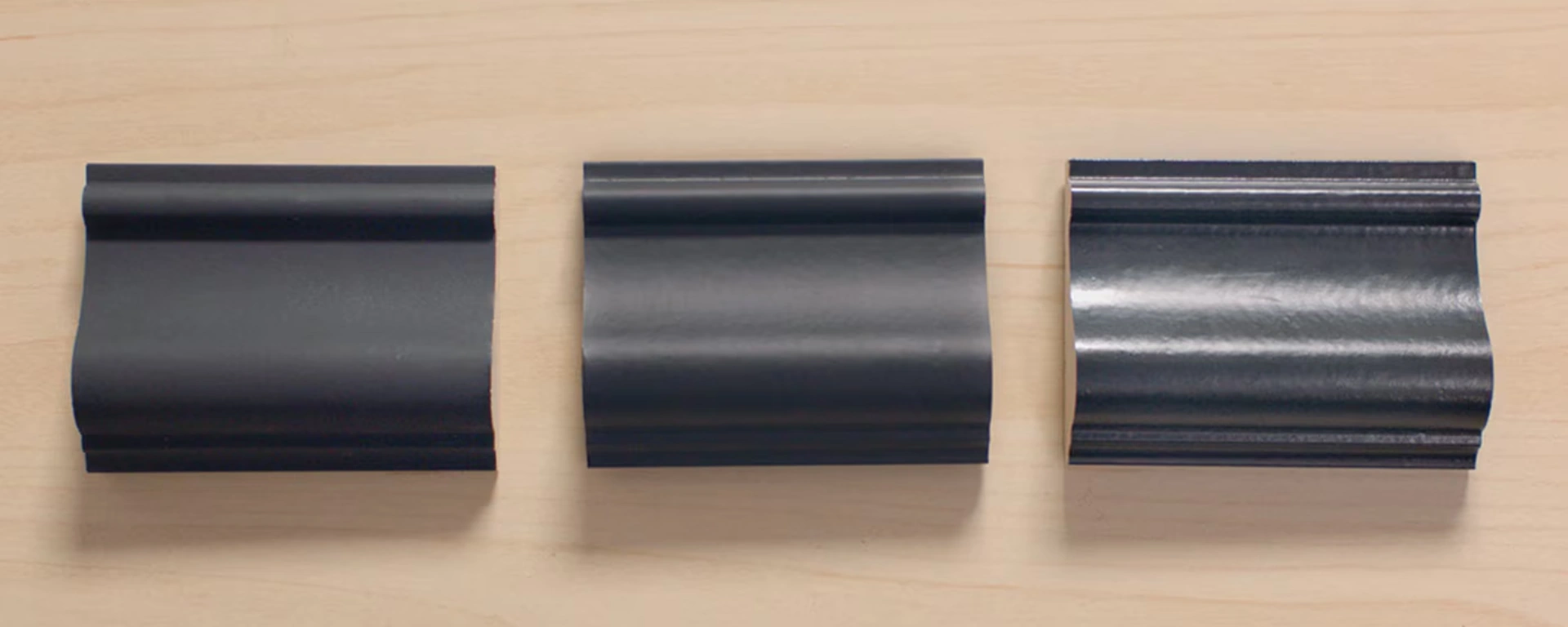

Understand paint sheen differences learn how matte, eggshell, satin, semi-gloss, and gloss finishes affect look, durability, and the best spaces to use each.

Unravel the complexities of house painting costs with our detailed guide. Discover what factors influence both interior and exterior painting expenses and how to budget for your project.

Master the art of exterior house painting with our ultimate guide. From selecting the right paint to surface preparation and application, transform your home’s exterior into a masterpiece.

Fill out the form below and we’ll be in touch to discuss your painting needs, answer your questions, and provide a clear quote for your project.