How to Match Paint with Architectural Style

Learn how to match paint with your home’s architectural style discover timeless color pairings that enhance character, balance design, and boost curb appeal.

Recent U.S. tariffs on imports from Canada, Mexico, and China are sending ripples across the paint and coatings industry. Already, supply chains are strained, raw material costs are rising, and North American trade flows are realigning. For Canadian contractors and homeowners, this means higher costs, tighter availability, and a need to adapt strategies now.

In early 2025, the U.S. government imposed sweeping 25 % tariffs on most Canadian, Mexican, and Chinese goods, with a lowered 10 % tariff on energy products. These trade actions, begun February 1 and set fully in effect by April, target a broad set of industries including components and materials vital to paint and coatings production.

The American Coatings Association immediately warned that these tariffs would introduce disruptions and increased costs across the industry. Canada, the U.S. coatings industry’s largest trade partner, supplies key raw materials and intermediates used in paint formulas. As tariffs drive up the cost of imported inputs, paint manufacturers in North America may face squeezed margins or be forced to pass costs downstream.

One consequence is that supply chains become more brittle. Even if a manufacturer sources locally, many specialty chemicals and additives (which often come from China or cross-border suppliers) could see tariff exposure or logistical delays. The PCI Magazine warned that supply-chain disruptions are likely, especially for coatings that rely on imported feedstocks.

For Canadian contractors and homeowners, the impacts are already materializing:

Higher material costs: Expect upward pressure on sealants, primers, specialty coatings, and additives. While not every paint line will see a sharp hike, margin-sensitive or premium products may adjust faster.

Inventory risk: As manufacturers conserve cash or slow production in response to tariff uncertainty, contractors may find it harder to get certain specialty products in a timely way.

Regional price variance: Local availability and freight costs will play a bigger role. Some cities might see steeper increases depending on import routes, border congestion, or distribution networks.

Contract risk: Fixed price contracts written before these tariff moves might become unprofitable. Contractors should build in clauses for raw material or import cost escalation.

The Canadian federal government responded by rolling back many counter tariffs on U.S. goods as of September 1, 2025, though tariffs on steel, aluminum, and automobiles remain. This easing helps some sectors but doesn’t directly relieve the raw-material pressures affecting paint lines.

A real world example underscores the volatility. Roustan Hockey, Canada’s last large-scale wooden hockey stick factory, has faced surprise tariffs and delays on cross border shipments even for small orders due to shifting U.S. customs enforcement. While not paint-related, their experience illustrates how small changes in trade policy can cascade into manufacturing delays and unexpected cost burdens for businesses.

1. Lock in pricing with suppliers early. If you know a project is coming up, negotiate your material rates now before further increments occur.

2. Increase buffer inventory for key items. For specialty coatings or additives that may be vulnerable to tariff shocks, keep more stock on hand if storage allows.

3. Revisit contract language. Add clauses that allow for material cost escalation or supply disruption in longer contracts, especially with high risk coatings.

4. Explore alternate sources. Investigate domestic or tariff-exempt manufacturers, regional formulations, or local specialty suppliers that may avoid cross-border risk.

5. Communicate with clients. Be transparent: explain tariff risk, potential cost variability, and why early commitments or flexible scheduling may be necessary to maintain quality.

Tariffs introduced by the U.S. in 2025 are reshaping supply flows and cost structures in the North American paint industry. For Canadian contractors and homeowners, the effects are already felt: higher input costs, supply uncertainty, and greater risk in fixed-price work. But with proactive planning, negotiating strategies, and smart sourcing choices, the best businesses can weather the turbulence and help clients through it with integrity and foresight.

Learn how to match paint with your home’s architectural style discover timeless color pairings that enhance character, balance design, and boost curb appeal.

2025 marks a new era of collaboration discover why strategic partnerships between trades are key to stability, growth, and smoother construction projects.

Learn how to spot early signs it’s time to repaint peeling, fading, cracks, and stains can signal wear. Keep your home fresh and protected with timely updates.

PPG sells its U.S. and Canadian architectural coatings business to American Industrial Partners, reshaping paint brands, pricing, and supply across North America.

Master surface preparation before painting learn pro tips for cleaning, sanding, patching, and priming to achieve flawless, long-lasting paint results every time.

Discover how to calculate paint quantity accurately for any project save money, avoid waste, and ensure perfect coverage with these simple professional tips.

Discover creative ways to use bold colors in your space learn how to balance vibrant tones with neutrals to create depth, personality, and modern style.

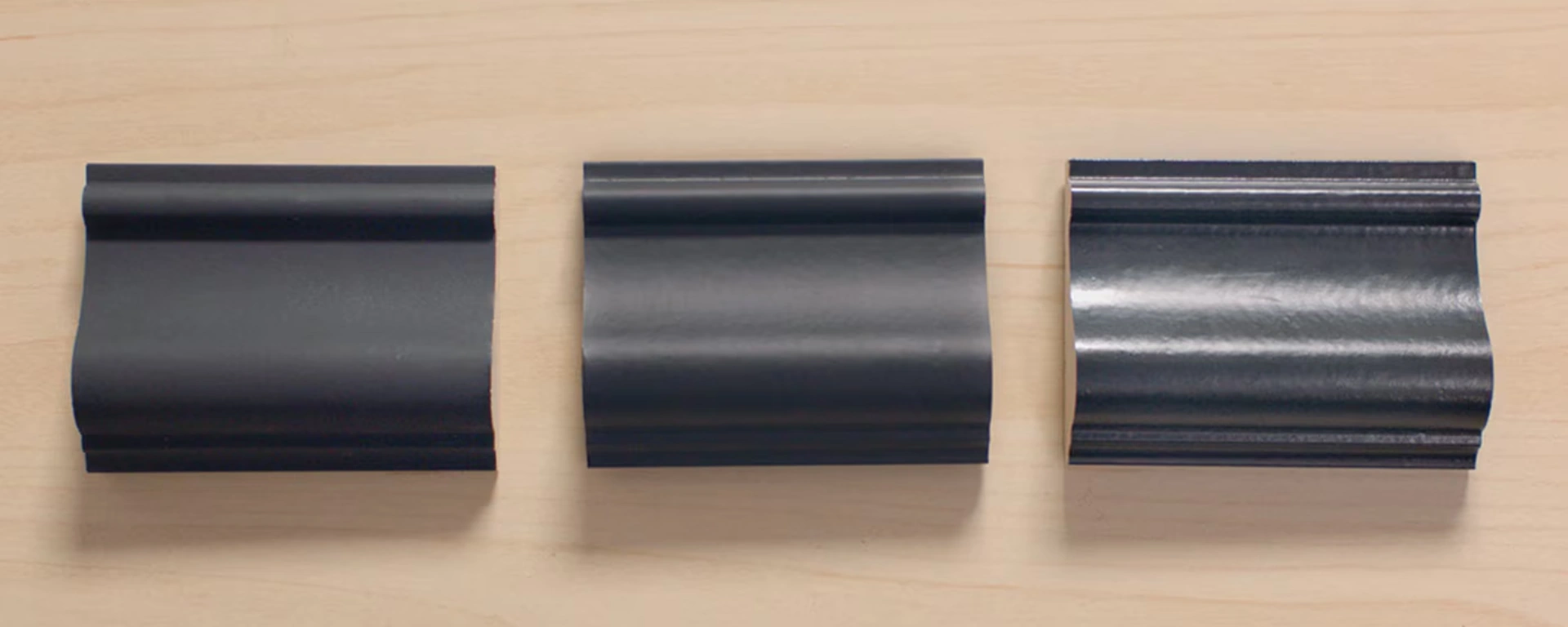

Understand paint sheen differences learn how matte, eggshell, satin, semi-gloss, and gloss finishes affect look, durability, and the best spaces to use each.

Unravel the complexities of house painting costs with our detailed guide. Discover what factors influence both interior and exterior painting expenses and how to budget for your project.

Master the art of exterior house painting with our ultimate guide. From selecting the right paint to surface preparation and application, transform your home’s exterior into a masterpiece.

Fill out the form below and we’ll be in touch to discuss your painting needs, answer your questions, and provide a clear quote for your project.